Social media and cryptocurrency, two of the most disruptive innovations of our generation, are now converging in the form of Friend Tech. Our comprehensive Friend Tech review delves into this new decentralized social platform built on blockchain technology.

We’ll take an in-depth look at Friend Tech to understand its core value proposition and analyze whether it represents the future of social media in the web3 era.

Here is what I will cover:

- What is Friend Tech?

- Popularity and Technical Aspects

- Behind the Scenes: The Team and Vision

- Friend Tech in Numbers

- Is Friend Tech Legit or a Scam?

- Pros and Cons of Joining Friend Tech

- How to Join Friend Tech: A Step-by-Step Guide

- Safety and Security on Friend Tech

- An Honest Talk About the Risks

- The Future of Friend Tech

- Conclusion

I’ve previously explored decentralized social platforms like Mastodon, which operates through a federation of user-controlled servers. Mastodon prioritizes user privacy and control, providing an alternative to centralized platforms like Twitter.

Long time ago, back in 2011, I’ve also covered pioneers like Empire Avenue, an early social game that allowed users to buy and sell shares in each other based on social media influence. Empire Avenue essentially created a virtual stock market for social profiles. It was later rebranded as Empire.Kred and converted into a subscription service. They had a problem allowing users monetize their token price.

Friend Tech combines elements of both – a decentralized social network fueled by crypto-economics. Unlike Empire Avenue, it utilizes real cryptocurrency and blockchain technology to create tradable social tokens with real financial value.

This merging of social networking and crypto finance has powerful implications…

Friend Tech introduces the concept of social tokens – digital assets representing the likeness and popularity of influencers and creators.

Core Mechanics of Friend Tech

- Users can buy keys of their favorite personalities on Friend Tech

- These keys provide access to exclusive group chats with that influencer

- As the influencer gains more followers, the price of their keys appreciates – providing financial incentives

In a nutshell, Friend Tech aims to merge social networking with crypto by transforming individual reputations into tradeable digital assets.

This potentially has powerful implications (if it works):

- It shifts control back to creators instead of platforms

- Fans can benefit financially from supporting rising stars early on

- Cryptocurrency adoption reaches mainstream audiences

Leading crypto investors like Paradigm see potential in this social-financial hybrid. They recently invested $50 million in Friend Tech.

Stoked to partner with @0xRacer and @shrimppepe.

— Charlie Noyes (@_charlienoyes) August 18, 2023

The most exciting crypto-native social apps might look nothing like Web2 analogs. After seeing Stealcam, we knew they were the team we wanted to explore with. https://t.co/vORLQht97H

What is Friend Tech and How Does it Work?

Let’s dive deeper into what exactly Friend Tech is and how it functions.

Friend Tech is a social networking app that runs on blockchain technology. It allows people to buy and sell “shares” or “keys” in other users to access special privileges like exclusive group chats.

The core concepts powering Friend Tech are:

Social Tokens

Every user gets their own ERC-20 social token that represents “shares” in their profile. The value of these tokens fluctuates based on the user’s popularity and engagement on the platform.

Buying Shares to Gain Access

You can buy someone’s tokens to gain access to special privileges like 1-on-1 chats. Popular users can set a higher minimum # of tokens required to get private access.

Selling Shares to Cash Out

If a user you’ve invested in becomes more popular, the value of your tokens in them increases. You can sell your tokens at any time to cash out your investment.

Group Interactions

Groups on Friend Tech require owning a minimum # of a user’s tokens to join. If you don’t want to be in the group anymore, you can sell your tokens. Buying more tokens also raises your status.

This creates an entire ecosystem around social valuation and access. Your popularity becomes an asset that can be traded. Fans who invest early can benefit financially too.

The blockchain backbone allows the tokens to have real monetary value, unlike previous social media virtual currencies. It’s social networking meets crypto investing!

Popularity and Technical Aspects of Friend Tech

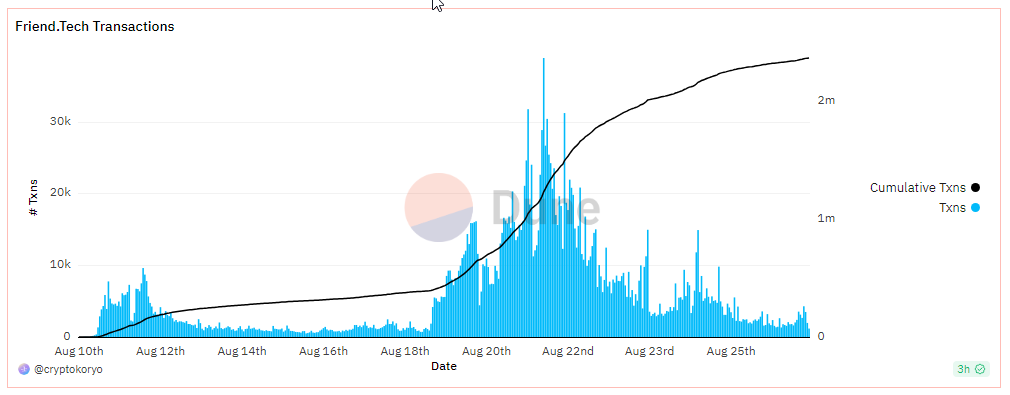

The rapid growth and adoption of Friend Tech has taken the crypto world by storm:

- Over 110,000 users joined the platform in just two weeks

- It has facilitated over 126,000 transactions and $80 million in trading volume already (in two weeks)

- NBA stars (Grayson Allen) , YouTube creators, and influencers across domains are flocking to it

This exponential virality demonstrates strong product-market fit. There is clearly demand for social interactions powered by crypto-economics.

But what makes this growth possible? Let’s look under the hood:

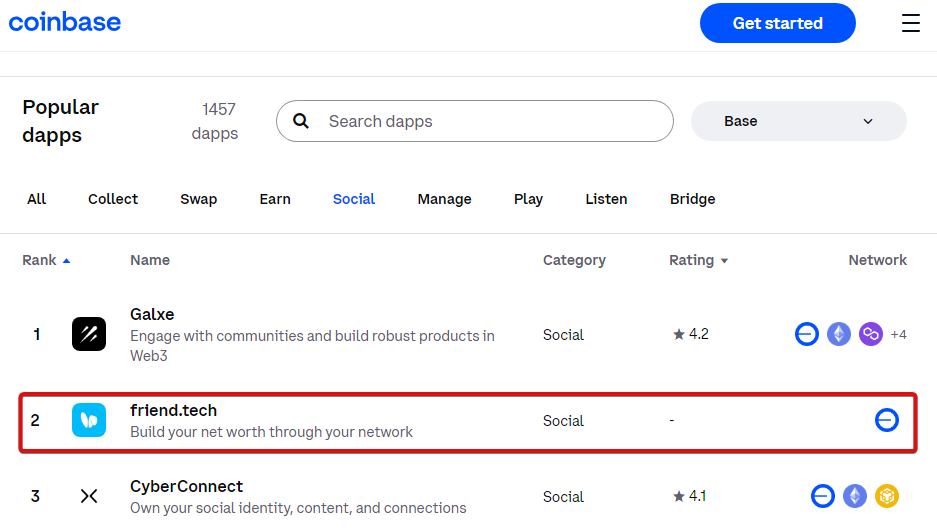

Built on the Base Network

Friend Tech is architected as a decentralized application (DApp) that runs on the Base Network – a layer 2 scaling solution for Ethereum created by Coinbase.

The Base Network allows Friend Tech to leverage Ethereum’s security while reducing gas fees and improving scalability. This best-of-both-worlds architecture is key to making it usable for mainstream audiences.

Without a layer 2 foundation, Ethereum’s high fees and congestion would throttle adoption. Base Network gives Friend Tech the performance it needs for rapid growth.

Mainstream Adoption Building Crypto Ramps

By focusing on creators and influencers first, Friend Tech smartly sidesteps crypto complexity. Mainstream users can easily onboard via established profiles they are already familiar with.

This replicates the playbook of exchanges like Coinbase that first targeted crypto enthusiasts before expanding to the mainstream. Crypto projects need “ramps” like Friend Tech to get normal users on board.

The tech enables it, but brilliant user-focused design is what ultimately bridges the gap to global adoption.

Behind the Scenes: The Team and Vision

While the app itself is generating massive buzz, who exactly is behind this viral phenomenon?

Friend Tech was created by two pseudonymous developers:

oxRacerAlt 🐤

A renowned builder of social apps like TweetDAO and Stealcam. He has extensive experience creating crypto projects with engaging user incentives.

Shrimppepe 🐤

A close partner of oxRacerAlt across multiple initiatives. Together they saw the potential of merging social networking with crypto economics.

Their pedigree of shipping viral crypto hits lends credibility. Friend Tech is not their first rodeo. However, hiding behind anonymity is definitely something that can causes concern.

Positioning for Mainstream Creator Monetization

The team could have focused Friend Tech heavily on crypto native personalities. But their vision is much broader.

They want to empower all types of creators – from artists to athletes to influencers – with monetization superpowers. The app is built for mainstream adoption beyond just crypto enthusiasts.

This approach supports a diverse group of creators in leveraging their social capital. It paves the path for mass onboarding by solving a universal problem.

The financial framework is set up so that as creators benefit, their followers have the potential to gain from owning social tokens early on.

The Meteoric Growth of Friend Tech

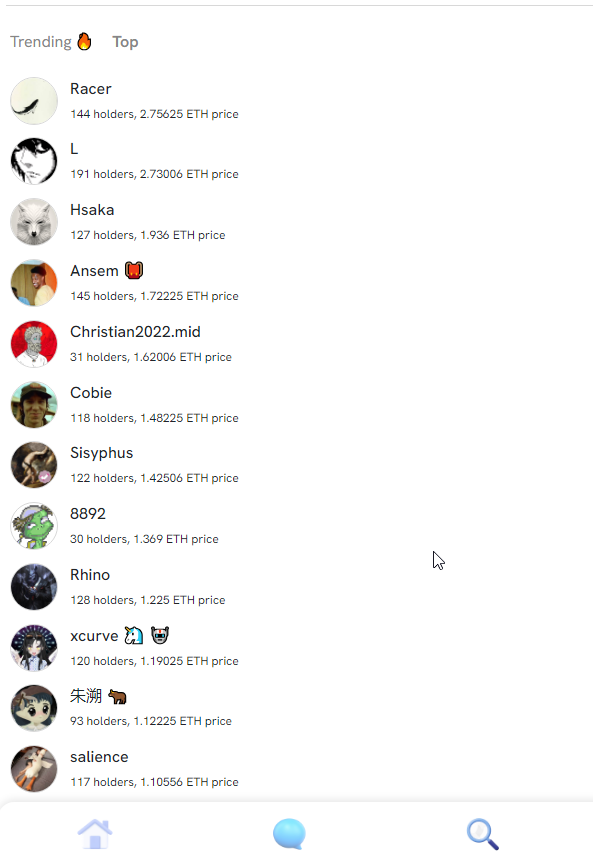

The raw statistics behind Friend Tech’s adoption are mind-boggling. $2 million in revenue generated, and the top 10 profiles have a fully diluted valuation of $1 million each.

This hockey stick growth even puts Friend Tech on par with top layer 2 networks on Ethereum like Optimism in terms of daily transactions.

Across crypto Twitter and Discord servers, the app is generating huge buzz:

Friend Tech really cements the ETH L1 / L2 thesis. The fact it has been tried on other platforms and DIDN'T work just adds to it.

— Kunal Goel (@kunalgoel) August 21, 2023

ETH has always had the cultural fit for viral apps but with L2s it has the tech too.

With such significant backing, ambitious founders, and rapid growth, one might be swayed by the promise of Friend Tech. But it’s essential to tread carefully; it’s still early days.

Evaluating the Legitimacy of Friend Tech

With the buzz surrounding Friend Tech, it’s crucial to ask: is this a sustainable venture or merely a fleeting trend? Let’s dive into some critical considerations:

| Title | Description |

|---|---|

| Traction and Usage | With over 100k users and mainstream celebrity adoption, Friend Tech has demonstrated real traction. This is not just a theory – people are actually using it. |

| Backers and Funding | Major crypto VCs like Paradigm backing Friend Tech with a $50 million investment lends credibility. These firms do extensive diligence. |

| Creators’ Pedigree | The developers behind it have repeatedly built viral crypto apps before. They know how to create organic engagement. |

| Transparency | Friend Tech has been quite transparent about its bonding curve model and fees. The core premise is clear, not hidden. |

Comparisons to Other Platforms

Early skepticism existed around NFTs and DAOs too, but the best projects proved viable. Friend Tech is going through similar growing pains.

No platform is perfect right out the gate. But the foundations of strong traction, funding, and an engaged community suggest Friend Tech has legs.

Of course, users should exercise judgment. But dismissing it as an outright scam could be equally foolish. The truth likely lies somewhere in between.

The Pros and Cons of Joining the Friend Tech Ecosystem

Should you jump into the Friend Tech craze or stay away? Let’s break down the pros and cons:

Potential Benefits

- Early access to invest in rising social media influencers

- Exclusive 1-on-1 chats with your favorite personalities

- Get paid for contributing content and driving engagement

- Speculate on popularity and cash out gains from hype cycles

- Upside if the platform sees mass adoption long-term

Potential Drawbacks

- Volatility and impermanence if interest in platform declines

- Locking up capital that could be used elsewhere

- Overpaying for temporary access to influencers

- Placing bets on unproven creators with no track record

- Limited ecosystem and features compared to Twitter or Discord

- High platform fees associated with transactions (20%) will hurt your earnings

Compared to other social platforms, Friend Tech offers unique stakeholder benefits. But it’s still early stage and comes with risks. Assessing your personal goals and risk appetite is advised.

Many are optimistic about the future potential – if executed well, Friend Tech could evolve into a mainstream platform with network effects and sustainability.

A Step-by-Step Guide on Joining Friend Tech

I took the plunge and joined Friend Tech myself to understand the onboarding experience first-hand.

Here is an easy step-by-step guide based on what I learned:

Step 1: Get an Invite Code

Friend Tech is still in closed beta. You need an invite code from an existing user to gain access. I got my invite code by asking for one on Twitter.

Tip: Check crypto Twitter and Discord to find someone willing to share an invite code. You can try to send me a message and I will be happy to help if I can.

Step 2: Visit the Site and Install the PWA

Use your mobile browser to visit www.friend.tech. Click the “share” button at the bottom and select “Add to Home Screen” to install the Progressive Web App.

Step 3: Link Your Social Profile

Friend Tech allows you to link your Twitter account. This helps populate your connections.

Be aware that at this stage your give permission to the Friend Tech to post on your behalf. You can later disable it from your twitter connect app settings.

Step 4: Fund Your Wallet

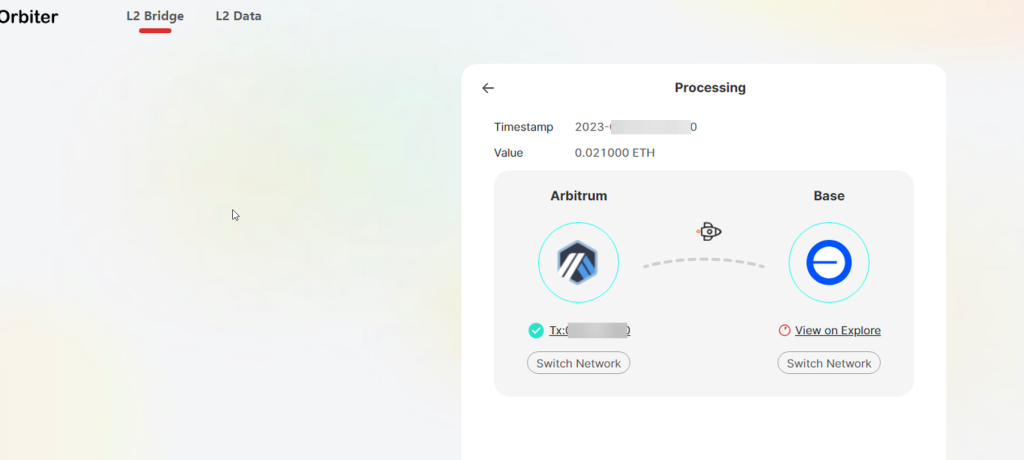

You need to fund your Base Network wallet with ETH to interact on Friend Tech. The minimum amount is 0.1 ETH ($18 at the time of writing this post) which is used to purchase your first key. I sent it from my MetaMask to the wallet address shown.

If you plan to purchase more keys (for your own profile or of other creators that you wish to follow), you might want to deposit higher amount.

Be aware that the ETH that you deposit should be on the Base network. If you don’t have ETH wrapped there, you need to bridge it. For that purpose I used Orbiter.

There are ways later in order to deposit more funds in case you need.

Step 5: Explore and Make Your First Purchase!

Now you have access to the app, you can look around see who is already there. Browse popular profiles and see who is active. I suggest that you choose someone you genuinely want to connect with and see if you can afford to join his inner circle. Buy 1-2 of their shares to access their chat room and say hello!

What I like about this concept is that it is like the patreon model, just gamified.

Start small as you get familiar with the platform. Be selective in who you engage with and invest in.

Step 6: Be Active, But Stay Balanced

Participate actively, while being careful not to over-index. Some hype is expected early on, but focus on forging genuine connections.

Leveraging Friend Tech requires being selective, taking some risks, and having patience as the ecosystem matures. Stay educated!

Staying Safe and Secure on Friend Tech

As with any new crypto platform, exercising caution around safety is advised. Here are some tips:

Beware of Scams

Stick to buying shares directly on Friend Tech. If random tokens appear from outside parties, they are likely scam attempts. Never send money or keys to untrusted accounts.

Start Small

When buying shares, make small purchases instead of going all in on one person. This mitigates risk as you learn the ropes.

Understand the Dynamics

Closely analyze the share buying/selling flows. Look for surges in activity or prices that may signal manipulation. Rational exuberance is expected, but beware of obvious pumps. Be aware of the platform transaction fees, they can easily hurt your ROI. Because the fees are high, usually buy and hold strategy is preferred.

Limit Connections

Be selective about linking outside social media accounts. Do not connect those with sensitive personal data. Create throwaway accounts if needed.

Use Anonymity

Avoid revealing personal details on the platform. You might want to conduct transactions from fresh wallets using VPNs and privacy measures to stay anonymous.

As with investing, risk management is key. Be proactive about security to maximize the upside of participating.

The Real Risks of the Crypto-Powered Friend Tech Social Platform

The promises of connecting with creators and earning upside as stakeholders are exciting. But we have to have an open conversation about the risks involved too.

Technical Issues

As a new platform built on emerging technology like blockchain, there is potential for bugs, hacks, and platform failures. Users could lose access or funds.

The app certainly feels new, not completely polished. It can be slow at time, hopefully the team will work to improve the UX.

Team Risk

There have been mentions and claims about the Friend Tech team’s previous engagements and their abrupt abandonment of past projects. While the specifics of these claims are not detailed here, they certainly raise questions about the team’s long-term commitment and dedication to the Friend Tech platform.

Market Volatility

The value of social tokens is dictated by hype cycles and user whims. Prices can fluctuate wildly based on speculative manias or loss in interest.

I advice you to read the following tweet, to understand the implications of the bunding curve of Friend Tech.

I did some math on https://t.co/EhPYP0i4vM and distilled it down to a simple inequality:

— cephalopod (@macrocephalopod) August 21, 2023

k > n/9

Bottom lines:

- The lower the number of keys a profile has, it is easier to make a profit — this is why sniper bots can do so well, they only need one person to follow them in.

- The larger the value of keys, the harder it is to make a profit. if there are 200 holders already then you need another 22 people to buy after you (net of sales) before you can come away with a profit after fees.

- the bigger that Friend Tech gets, the harder it will be for anyone to make a profit since almost all revenues will accrue to the protocol and the people who run the biggest accounts (most shares outstanding). On the flip side: maybe getting early, i.e now, is actually a good opportunity? Only time will tell

Dependence on Influencers

If prominent personalities on Friend Tech leave or fall from grace, associated social tokens may crash. You are reliant on their continual activity.

Pump and Dump

When purchasing into a creator, be aware that you might be the exit volume for the early investors.

Regulatory Uncertainty

There are open questions around how regulators may view social token structures. Future restrictions could impact liquidity and viability.

The core promise may be strong, but prudent risk management is a must. Some tips:

- Invest only what you can afford to lose

- Diversify across multiple personalities and groups

- Sell portions during hype spikes; don’t get caught holding bags

- Keep an eye on platform updates and influencer trends

There are always risks with new technologies and markets. But educated participation and balanced strategies can mitigate them.

Envisioning the Future Evolution of Friend Tech

Friend Tech is still in its early innings, but the pace of innovation in crypto can quickly transform products. Some possibilities:

Mainstream Adoption

If Friend Tech nails wide demographic appeal beyond just crypto, it could reach millions of users and explode in popularity like TikTok. Network effects take over.

Competing with Incumbents

As it scales, Friend Tech may end up competing with and eating market share from social giants like Twitter, Facebook, and Instagram.

Evolution to Metaverse

The platform could evolve into a portal for branded metaverse experiences where fans interact with creators via virtual worlds and digital assets.

New Features

Additional features like exclusive content subscriptions, gifting, tipping, and multimedia unlockables could be introduced over time.

Airdrop

There is an airdrop section inside the app. Points are distributed every Friday, based on your actions in the app. The company hasn’t announced what will the points be used for. Just assuming that 30% of the FDV is airdropped to the users as points, Friend.tech might give away $60 million to users. And with 100 million points to work with, each point could be valued at $0.60.

Governance Capabilities

Letting users and creators vote on platform upgrades taps the wisdom of the crowd. Friend Tech could leverage DAO-like governance.

Sustainable Creator Economy

Balancing creator incentives with community ownership will be key to keeping growth going. The business model has to be sustainable.

The possibilities are endless given the convergence of social media, crypto, and the passion economy. By getting in early, users and creators can help guide the evolution.

Final Thoughts on the Promises and Perils of Friend Tech

Friend Tech is at the intersection of social media, cryptocurrency, and creator monetization, paving the way for a user-driven economy. Its potential is transformative, hinting at a fresh online collaboration and value-sharing paradigm.

However, like all innovations, challenges and growth stages are inevitable. Community-driven governance must evolve alongside technology. For those discerning enough, Friend Tech previews web3’s social future.

Engage thoughtfully, contribute feedback, and support communities that align with you. Together, we can redefine social media for empowerment, not extraction.

The tools and potential are in our hands, let’s shape our digital world. I encourage you to jin Friend Tech and share your experience.

P.S: If you read till here and you are in Friend Tech app, look for me. I will be considering it an honor if you decide that I am purchase worthy. I am thinking of ways how I can use my secret room there as a patreon-like community, with closer access to me. My handle there is like my twitter: @hhezi

Disclaimer:

The information and opinions expressed in this article are for informational purposes only and should not be considered as financial advice. Readers should do their own research and consult with a financial professional before making any investment decisions. The author is not responsible for any actions taken as a result of reading this article. Cryptocurrency investments are volatile and can result in significant losses. Past performance is not indicative of future results.

Hezi Hershkovitz

Latest posts by Hezi Hershkovitz (see all)

- The 7 types of Entrepreneurship: Which One Are You? - September 26, 2023

- Friend.Tech Strategies: Simple Profit Explosion - September 22, 2023

- Friend Tech Taxation: Unraveling the Colossal Implications - September 18, 2023