A Brief Introduction to Friend Tech

Friend.Tech emerged in August 2023 as an innovative platform seeking to redefine social media by seamlessly integrating community engagement with new models of finance and ownership. Friend.Tech is rooted in the vision of harnessing technology to foster human connection and enable collective prosperity. The post will delve into Friend.Tech Strategies that you can adopt to increase your profits while leveraging the platform’s unique capabilities.

This post is #4 in my overview of Friend.Tech related subjects. You can find the other posts here:

#1: Friend Tech Review: A Critical Look at the New Social Sensation

#2: How to Effectively Make Money with Friend Tech

#3: Friend Tech Taxation: Unraveling the Colossal Implications

Fundamentally, Friend.Tech seeks to move beyond the typical content consumption and advertising models ruling today’s social media. Instead, it opens doors for users to invest in digital social capital, gaining access, influence, and shared ownership alongside the creators and leaders who add value to the platform.

This platform enables the trade of “keys” to unveil social access, group memberships, and higher privileges. By buying keys, users can directly support and interact with top content creators, experts, and celebrities on Friend.Tech. The key prices are dynamically set through bonding curves, letting the value of social capital emerge from community interactions.

Table of contents for this post:

- The Emergence of SocialFi

- Unpacking the Complexity of Friend.Tech

- Friend.Tech Strategies: Navigating Speculations for Profit Maximization

- Community Dynamics and Engagement

- Future Prospects and Potential Business Models

- Technical Insights and Platform Developments

- Envisioning the Future of Friend.Tech

- Conclusion: Join the Movement

The Emergence of SocialFi

Blending social interaction with cryptocurrency-driven finance, Friend.Tech stands at the helm of a budding movement termed “social finance” or “social-fi.” Although risky and speculative, this venture aims to align incentives, encourage collaboration, and explore new avenues of digital community building.

Aiming to gamify online social interaction while empowering users to invest in each other’s success, Friend.Tech holds promise as an exhilarating platform to observe as it evolves. Despite the uncertain journey ahead, the early community’s vibrancy hints at the potential impact of this social-fi experiment.

Unpacking the Complexity of Friend.Tech

The Bonding Curve

The heartbeat of Friend.Tech lies in its unique mechanism known as the “Bonding Curve.” This concept, while complex, is the cornerstone of the platform’s dynamics. To truly grasp its implications, we need to dissect it step by step.

At its core, the bonding curve represents a mathematical curve that dictates the relationship between the price of a token and its supply. It serves as a guideline for users to understand potential price movements, thereby aiding in making informed investment decisions. The curve embodies the essence of reciprocity and reputation, fostering a community where mutual benefits are the norm.

However, it is essential to approach this with a cautious optimism. While the curve offers insights into potential profit avenues, it also comes with its share of risks. The ever-changing dynamics necessitate a deep understanding and a strategic approach to navigate the potential pitfalls successfully.

Platform Features and Functionalities

Friend.Tech is not just about numbers; it’s a vibrant community teeming with features and functionalities that enhance user experience. Let’s dissect a few critical aspects:

- The Watch List Feature: A critical tool in the Friend.Tech arsenal, the Watch List allows users to keep an eye on potential investment opportunities. It acts as a beacon, guiding users to make informed decisions based on real-time data and community insights.

- Community Suggestions for Feature Improvements: Friend.Tech thrives on community engagement. It fosters a space where users can suggest improvements, thereby creating a platform that evolves with the needs and preferences of its community.

As we venture deeper, it’s vital to keep a balanced perspective, acknowledging the potential for profit while being aware of the inherent risks. As we move forward, we will explore strategies that can potentially maximize profits while minimizing risks.

Friend.Tech Strategies: Navigating Speculations for Profit Maximization

3-3, Friend-Friend, and 9-9 Strategies

In the bustling marketplace of Friend.Tech, the 3-3 and 9-9 strategies stand as beacons of innovation and community engagement. Here, we uncover the layers of these strategies, guiding you through the steps and alerting you to the possible risks.

Understanding the 3-3 (aka Friend-Friend) Strategy: Origins and Evolution

The 3-3 strategy, also known as the Friend-Friend strategy, is more than just a financial maneuver; it’s a community-building initiative. It has origin in the Olympus DAO project, where it ended badly. Here is a refresher about ve(3,3) model.

In the context of Friend.Tech, here’s how you can embark on this strategy:

- Step 1: Connect with three friends who are also active on Friend.Tech.

- Step 2: Engage in reciprocal transactions with these friends, where you buy keys from each other to inflate the value of the keys.

- Step 3: Maintain a cycle of buying and selling, fostering a network that grows organically, enhancing the value of your portfolio.

However, this strategy is not without its risks. The primary concerns are:

- Market Volatility: The value of keys can fluctuate, potentially leading to losses.

- Dependency: Your profit is tied to the engagement level of your friends, which can be inconsistent.

- Potential for Conflict: Financial transactions among friends can sometimes lead to disagreements and conflicts.

Here is very good resource to sum it all up:

Advancing to the 9-9 Strategy

Although it’s not yet available. The implementation of this strategy hinges on the development of a lend and borrow protocol on Friend.Tech, where users can use their keys as collateral to borrow.

The 9-9 strategy, while promising, carries its set of challenges and risks:

- Increased Complexity: Managing a larger group demands enhanced coordination.

- Higher Stakes: Bigger investments ramp up the stakes, with potential for notable losses.

- Market Dynamics: More players in the group introduce variables that affect market dynamics, complicating predictions and strategies.

- Quick Liquidations: The lending and borrowing aspect of the 9-9 strategy could lead to swift liquidations, especially in adverse market conditions.

- Potential to Spiral Out of Control: Like the 3-3 strategy, the 9-9 strategy could spiral cataclysmically, leading to cascading liquidations and significant losses if not managed cautiously.

The 9-9 strategy is a tantalizing prospect for scaling up from the 3-3 strategy, awaiting the crucial lend and borrow protocol to unlock its potential. As this strategy could fundamentally alter the dynamics on Friend.Tech, it’s a development worth keeping an eye on.

Flipping New Accounts Quickly

In the fast-paced environment of Friend.Tech, flipping new accounts quickly has emerged as a popular strategy. This involves buying keys for new accounts and selling them swiftly to make a profit. However, this strategy comes with risks such as market unpredictability and potential for quick losses if not executed with caution.

An essential aspect to be aware of in this strategy is the presence of sniper bots. These automated bots are designed to execute trades at an exceptionally high speed, often outpacing human traders in buying low and selling high. Sniper bots have significantly affected the trading dynamics within Friend.Tech, making the competition for flipping new accounts more intense and the market more volatile.

These bots can lead to rapid price fluctuations, creating opportunities for high returns, but also increasing the risk of losses. Traders may find themselves buying at a peak and facing a sudden price drop, orchestrated by sniper bots offloading assets, resulting in what is commonly referred to as “getting dumped.”

How to Maximize Your Chances

To avoid falling victim to such tactics and to ensure a safe trading experience, traders should:

- Stay Informed: Keep abreast of market trends, price movements, and the presence of bots. Being well-informed can help traders make timely and educated decisions.

- Set Clear Trading Goals: Define clear entry and exit points, profit targets, and stop-loss levels. Having a well-thought-out trading plan can help mitigate risks and prevent impulsive decisions.

- Use Caution with New Accounts: Exercise extra caution when trading new accounts, as these are often the primary targets of sniper bots looking to capitalize on price discrepancies.

- Verify Authenticity: Before engaging in trades, verify the authenticity of accounts and transactions to avoid falling prey to scams and fraudulent activities orchestrated by malicious bots.

- Diversify Investments: Spread investments across multiple assets and accounts to reduce the impact of potential losses due to bot activities.

You can try to be a sniper yourself. It is quite easy to find the profiles that engage in such activities, some of them post about their achievements and strategies on Twitter:

By adopting these practices and staying vigilant, traders can navigate the challenges posed by sniper bots, optimize their trading strategies, and maximize their profit potential within the Friend.Tech ecosystem.

Using Notification Tools

In the fast-paced world of Friend.Tech, staying one step ahead is the key to success. This is where notification tools come into play. These tools, such as Alphador AI, offer users a competitive edge, providing timely alerts and insights into market dynamics. Here’s how to leverage these tools to your advantage:

- Step 1: Register with notification platforms that offer real-time alerts on new account drops and market fluctuations.

- Step 2: Customize your notification settings to align with your investment strategies, ensuring you receive relevant alerts.

- Step 3: Act swiftly on the notifications, making informed decisions based on the insights provided by the tools.

But beware, as these tools also come with their share of risks:

- Information Overload: Users might find themselves overwhelmed with a plethora of notifications, making it challenging to sift through the information effectively.

- Dependence on Technology: Over-reliance on these tools can sometimes lead to neglecting personal judgment and insights.

- Potential Technical Glitches: Like any technology, these tools are prone to glitches and inaccuracies, potentially affecting your investment decisions.

Farmer Strategy

The Farmer Strategy is a methodical approach to Friend.Tech, where users focus on steadily increasing their portfolio value through informed investments. Here’s how you can cultivate success through this strategy:

- Step 1: Identify potential accounts with promising prospects, focusing on new accounts that offer opportunities for growth.

- Step 2: Invest in these accounts, nurturing them through calculated buys and sells, aiming to inflate the portfolio value gradually.

- Step 3: Engage with the community to gather insights and tips, utilizing the collective knowledge to foster portfolio growth.

However, this strategy is not without its pitfalls:

- Slow Growth: The farmer strategy often involves a slower growth trajectory compared to other more aggressive strategies.

- Market Uncertainties: The strategy is susceptible to market fluctuations, which can sometimes derail the growth plan.

- Time-Consuming: This strategy requires a significant time investment to monitor and nurture the portfolio effectively.

If you have the capital, you can jump start yourself into the this strategy. One of the most efficient ways of doing this is unloading Eth on accounts that have a really low price and basically owning all of the shares. There are taxes involved with this but the downside is capped with nobody else being able to dump on you.

Here is a tweet that goes more in depth:

Swing Trader Strategy

For those seeking a dynamic approach to Friend.Tech, the Swing Trader Strategy beckons. This strategy involves buying and selling keys in response to market swings, aiming to capitalize on the fluctuations. Here’s your step-by-step guide to mastering this strategy:

- Step 1: Develop a keen understanding of the market dynamics, focusing on the factors that influence price swings.

- Step 2: Implement a strategy that involves buying keys at low prices and selling them when the prices swing upwards.

- Step 3: Stay abreast of community discussions and insights, utilizing the collective knowledge to make informed decisions.

But remember, this strategy comes with its set of challenges:

- Market Volatility: This strategy is heavily influenced by market volatility, potentially leading to significant losses.

- Requires Expertise: Successfully navigating this strategy requires a deep understanding of market dynamics and a knack for predictions.

- High-Stress Levels: The swing trader strategy can be stressful, requiring constant monitoring and swift decision-making.

Leveraging Self-Buying for Profit Maximization

In the dynamic landscape of Friend.Tech, users are continually exploring innovative strategies to optimize their earnings. One such tactic that has gained traction is self-buying. This strategy involves users purchasing their own assets or keys, thereby inflating the perceived value and demand for their accounts.

Self-buying serves multiple purposes in the Friend.Tech ecosystem:

- Price Inflation: By buying their own assets, users can artificially inflate the price, creating an illusion of higher demand and value. This can attract potential buyers willing to pay a premium for the assets.

- Enhanced Visibility: Accounts with higher trading volumes and prices gain more visibility within the platform. Self-buying contributes to increased activity, making the account more noticeable to other users and potentially attracting more buyers.

- Strategic Positioning: Users employing the self-buying strategy can strategically position themselves in the market, controlling the supply and demand dynamics of their assets. This allows for greater influence over market perception and pricing.

- Risk Mitigation: By controlling the buying process, users can manage the pace and price points of the transactions, mitigating the risks associated with market volatility and price fluctuations.

A Balanced Approach to Profit

However, it is crucial for users and investors to approach self-buying with caution. While it can offer opportunities for profit maximization, it also presents risks. Investors should be wary of accounts that engage in self-buying, as they can potentially “dump” assets, leading to rapid price declines. Additionally, some accounts may use alts accounts to further inflate their value artificially, adding another layer of risk.

Detecting such activities can be challenging, making it essential for investors to be extra vigilant and conduct thorough due diligence.

If you decide to use self-buying as a strategy, I advise paying close attention to transparency, ethical considerations, and community sentiment, as these are essential to ensure the sustainability and success of this approach. By understanding the mechanics and implications of self-buying, users and investors can make informed decisions, balancing the potential rewards with the inherent risks, and leveraging this tactic to enhance their profitability within Friend.Tech.

How to Find Opportunities

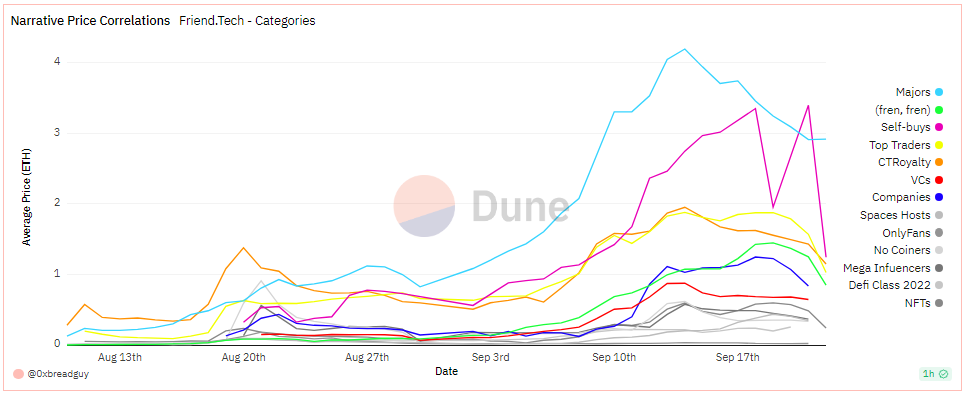

I found a nice resource that manually curate accounts based on the categories that they utilize:

Friend.Tech Strategies for Individuals to Optimize Airdrop Gains

The forthcoming airdrop stands as a golden opportunity for the users of Friend.Tech, enabling them to reap rewards without any initial investment. Serving as a mechanism to align incentives, the airdrop is designed to both enrich the actively participating community members and allure new users with the prospect of earning “free money”.

For those already in the Friend.Tech community, the airdrop is a gateway to elevate their profits, provided they strategize effectively. Below are several strategies individuals might employ to optimize their airdrop gains:

Analyzing past points distributions

The points are distributed every Friday, people are analyzing the distribution in order to understand what affects it.

For now, it seems that portfolio value is the biggest factor

Strategic Key Purchases for Point Farming

acquire keys linked to accounts poised to secure substantial airdrop allocations. Some accounts promise to share their airdrop profits with their followers, but that’s a promise that I don’t recommend you to trust blindly.

- Look for accounts boasting high Total Value Locked (TVL) and engagement metrics.

- Weigh the costs against the anticipated returns from farming.

- Consider acquiring keys of emerging accounts showcasing growth potential.

Boosting Community Engagement

- Engage proactively in community forums and spaces.

- Share valuable insights and content to demonstrate your value to fellow community members.

- Prioritize meaningful engagement over quantity of interactions.

- Actively partake in community dialogues, sharing your knowledge and learning from peers.

Community Dynamics and Engagement

Finding and Leveraging Niches

In the competitive environment of Friend.Tech, identifying and capitalizing on specific niches is a critical strategy for users aiming to establish a strong foothold. To successfully leverage niches, users should engage in comprehensive market research to pinpoint areas where their expertise can add substantial value. Building a robust network within these niches facilitates the sharing of specialized knowledge and fosters a collaborative atmosphere.

However, users should be aware of the challenges associated with niche marketing. High competition levels, substantial time investments in content creation, and potential limitations on growth are factors to consider. Despite these challenges, a well-executed niche strategy can yield significant benefits, including establishing oneself as a thought leader in the respective area.

Community Conversations

Community conversations are vital components of the Friend.Tech platform, providing a forum for knowledge exchange and collaboration. Active participation in these discussions allows users to gain deeper insights into the platform’s dynamics, benefiting from the collective wisdom of the community.

To optimize the benefits derived from these sessions, users should adopt a proactive approach, actively seeking advice and sharing personal insights. Building a network of contacts through these platforms can be a valuable resource, aiding in the user’s journey in the Friend.Tech ecosystem.

However, participants should be prepared to navigate a complex landscape of diverse opinions and potential conflicts. Effective participation requires diplomatic engagement and a willingness to invest time in fostering meaningful dialogues. By navigating these discussions professionally, users can enhance their understanding and develop strategies that align with their goals.

Future Prospects and Potential Business Models

The Road Ahead for Friend.Tech

As we steer forward into the evolving landscape of Friend.Tech, it becomes imperative to analyze the potential avenues of growth and development that lie ahead. The platform stands at a juncture where the amalgamation of community engagement and financial strategies is expected to flourish further, potentially opening up diverse business models.

Entrepreneurs and online marketers should keenly observe the unfolding trends and position themselves to capitalize on emerging opportunities. Strategic alliances, product developments, and community-based initiatives are expected to be the driving forces propelling Friend.Tech into a future characterized by innovation and growth.

Developing Business Models and Value Propositions

In the dynamic environment of Friend.Tech, the development of robust business models stands as a pillar of sustainability and growth. Users aiming to carve out a successful trajectory should focus on crafting value propositions that resonate with the community.

Identifying gaps in the market and developing solutions that address these gaps could be a viable strategy. Furthermore, leveraging analytics and data-driven insights to refine business models can potentially yield higher success rates. It’s a journey of continuous adaptation and innovation, where users are encouraged to iterate and evolve their strategies to align with the changing dynamics of the platform.

However, it’s crucial to approach this journey with a balanced perspective, understanding that the road ahead might be marked by challenges and uncertainties. Users should be prepared to navigate potential market fluctuations and competition, adopting a strategic approach to risk management.

Technical Insights and Platform Developments

A Closer Look at Proxy Contracts

Rumors suggest the upcoming arrival of proxy contracts on Friend.Tech, acting as intermediaries to ease transactions within the ecosystem. Grasping these contracts’ mechanics can offer insights into platform operations, aiding in crafting informed strategies.

Proxy contracts aim to address existing smart contract limitations on Friend.Tech, especially around key non-transferability. They allow users to buy shares, introducing a new level of flexibility and transferability. Being open-source and permissionless, the proxy contract records share ownership, facilitating share transfers and sales.

This approach unlocks notable value within Friend.Tech, fostering a more fluid ecosystem where assets can be shared, traded, and even lent. It also extends the platform’s functionalities, enabling off-platform activities and new lending protocols, potentially drawing a wider user base and enhancing community engagement.

Furthermore, the proxy contract unveils opportunities for earning interest, easing Over-The-Counter (OTC) markets, and improving user experience. Although adding some operational complexity, the benefits in flexibility, diversification, and value optimization are significant.

For users and investors eyeing to harness Friend.Tech’s potential, understanding the forthcoming proxy contracts is crucial. They provide a pathway to unlock, share value, and explore growth, collaboration, and financial prosperity in the digital realm.

Addressing Issues and Bugs

In the realm of technology, addressing issues and bugs is a continuous process. The Friend.Tech platform, being a technologically driven ecosystem, is no exception. Users should be cognizant of the ongoing developments and updates that aim to enhance the user experience by rectifying technical glitches and improving functionalities.

Engaging with the developer community and staying abreast of updates can be a valuable strategy, enabling users to adapt swiftly to changes and optimize their strategies accordingly.

Envisioning the Future of Friend.Tech

The Friend.Tech ecosystem beckons with promises of innovation, community building, and financial growth. It’s an evolving narrative, a dynamic space where technology meets community, forging pathways that could potentially redefine the way we perceive online interactions and financial strategies.

Mapping the Growth Trajectory

The trajectory that Friend.Tech is poised to take is one characterized by continuous growth and adaptation. As users, entrepreneurs, and marketers, the onus is on us to navigate this vibrant space with a keen eye on emerging trends and developments. The road ahead promises opportunities, where strategies morph and evolve, giving rise to business models that are as dynamic as the platform itself.

The essence of Friend.Tech lies in its community-centric approach, where engagement is not just a strategy but a philosophy. It’s a space where collaboration fosters innovation, where the exchange of ideas gives rise to solutions that resonate with a diverse user base.

Conclusion: Join the Movement

Congratulations, you are now equipped with strategies to maximize your profits with Friend.Tech.

As we envision a future marked by growth and innovation, I invite you to join this vibrant movement. Engage with the community, share your insights, and be a part of a narrative that is shaping the future of online engagement and financial strategies.

To stay updated on the latest developments and insights, follow me on Twitter: @hhezi

For those seeking to delve deeper, purchasing my Friend.Tech keys offers exclusive access to up to date content that will enhance your journey in this dynamic space.

Hezi Hershkovitz

Latest posts by Hezi Hershkovitz (see all)

- The 7 types of Entrepreneurship: Which One Are You? - September 26, 2023

- Friend.Tech Strategies: Simple Profit Explosion - September 22, 2023

- Friend Tech Taxation: Unraveling the Colossal Implications - September 18, 2023